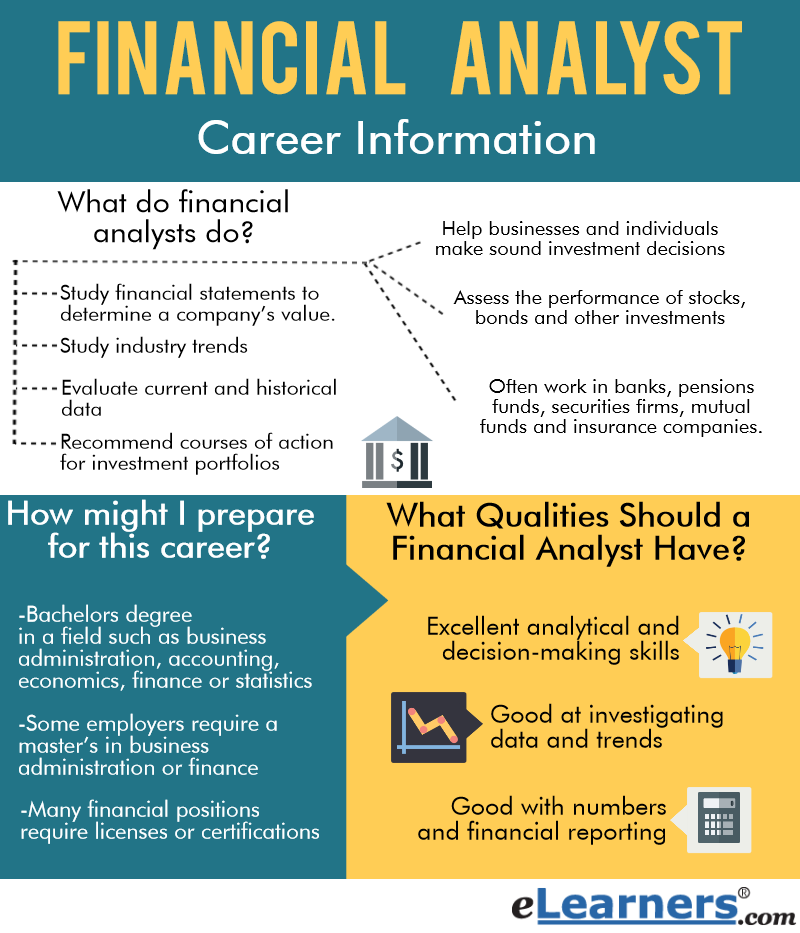

Mathematics of Finance. Module Title: Index: Earning View: Spending and Saving: View: Credit View: Simple Loans View: Auto Ownership View: Home Ownership View: Insurance View: Investment View: Retirement Planning View: Budgeting and Planning View. Our MSc in Mathematics and Finance is designed to prepare you for a wide range of careers in quantitative finance and risk management. Mathematical finance is a subject that is both mathematically challenging and deployed every day by sophisticated practitioners in the financial markets. com more than 4, 000 Jobs in Mathematics, Statistics and applications. If you have advanced math skills, consider a master's degree in mathematical finance Financial Mathematics is one of the fastest growing areas of applied mathematics. Institutions that employ financial mathematicians are amongst the wealthiest and most sophisticated corporations in the world. Start main page content Mathematics of Finance Unsure of whether to choose a career in finance or computers? The Mathematics of Finance programme combines the best of both worlds with topics in accounting, economics and corporate finance, together with computer science and applied mathematics. Gene Ekster Speaks on Alternate Data (Watch it Here)Petter Kolm Presented at the 5th Annual Globabl Quantitative Strategy Conference at Deutsche Bank The Basics of Financial Mathematics Spring 2003 Richard F. Bass Department of Mathematics University of Connecticut These notes are c 2003 by Richard Bass. They may be used for personal use or class use, but not for commercial purposes. If you nd any errors, I would appreciate The latest Tweets from Mathematics in Finance MS Program at NYU Courant (@MathFinanceNYU). Mathematics in Finance MS Program at NYU Courant. New York City If you want to explore the strong relationship between mathematics and financial analysis, this course is for you. You learn from experts involved in research in pure and applied mathematics, as well as finance. An Introduction to the Mathematics of Finance: A Deterministic Approach, Second edition, offers a highly illustrated introduction to mathematical finance, with a special emphasis on interest rates. This revision of the McCutcheonScott classic follows the core subjects covered by the first professional exam required of UK actuaries, the CT1 exam. This course is for students who want a solid grounding in the mathematics discipline, while exploring topics related to finance and actuarial science to open up a. Journal of Mathematical Finance (JMF) aims at presenting the latest development on pure and applied financial mathematics. It considers important theoretical, empirical and review papers. The Bachelor of Science degree in Applied Mathematics and Finance is a true interdisciplinary program between business and mathematics and includes digital. The text is interspersed with a multitude of worked examples and exercises, so it is ideal for selfstudy and suitable not only for students of mathematics, but also students of business management, finance and economics, and anyone with an interest in finance who needs to understand the underlying theory. This maths and finance degree provides the training needed to succeed and rise above the rest in today's financial industry. S096 Topics in Mathematics with Applications in Finance, Fall 2013 View the complete course: Instructor: Peter Kempthorne. An Introduction to Financial Mathematics Sandeep Juneja Tata Institute of Fundamental Research, Mumbai juneja@tifr. in 1 Introduction A wealthy acquaintance when recently asked about his profession reluctantly answered that he is a middleman in drug trade and has made a fortune helping drugs reach European The following is a list of the most cited articles based on citations published in the last three years, according to CrossRef. Apply for our Mathematics with Finance and Accounting BSc with Professional Placement to spend a year carrying out paid work in the financial sector as part of your degree. As well as helping you to stand out from the crowd and secure graduate employment, a placement is an excellent opportunity to develop your business skills and put your. This is a good introduction to the theory side of mathematical finance, with the minimum amount of required higher mathematics. I recomment reading this after getting a nontechnical introduction to finance, for example, by reading [[ASIN: Investments (6th Edition). A pioneer in its field, our Program offers 15 months of accelerated, integrated coursework that explores the deeprooted relationship that exists between theoretical and applied mathematics and the everevolving world of finance. Excellent descriptions of mathematical finance and the careers and opportunities available to students are provided by the International Association of Financial Engineers and the Courant Institute for Mathematical Sciences. For more technical information about quantitative finance and risk management, visit the websites of Global Derivatives, the Global. vi Mathematics for Finance systems of linear equations, add, multiply, transpose and invert matrices, and compute determinants. In particular, as a reference in probability theory we Our Mathematics and Finance programme is designed to provide you with a sound basis of knowledge and skills in the main areas of mathematics and finance and also a detailed understanding of abstract mathematical concepts, logical argument and deductive reasoning. 200 ChAPTER 5 Mathematics of Finance A deposit of dollars today at a rate of interest P for years produces interest of t r I Prt. The interest, added to the original principal P, gives P Prt P11 rt2. This amount is called the future value of P dollars at an interest rate r for time t in years. When loans are involved, the future value is often called the maturity value of the loan. Module code: ACFI 1303 Module description. It is generally acknowledged that economic events shape our everyday life in an unparalleled way. As a social science, economics is required to determine, address and precisely monitor the consequences of such social phenomena and when possible to contribute in their exante prediction. A degree in Mathematics and Finance provides a solid foundation for careers in the financial industry and graduate studies in financial engineering and mathematical finance. Graduates of our program can apply mathematical and statistical techniques to analyze financial products and manage financial risk. An introduction to the study of financial mathematics in its own right or as a supplement to a business finance text, the second edition of this Australian text has been thoroughly revised and updated. It assumes minimal prerequisite knowledge. This textbook presents three major areas of mathematical finance at a level suitable for second or third year undergraduate students in mathematics, business management, finance or economics. An undergraduate degree in mathematics provides an excellent basis for graduate work in mathematics or computer science, or for employment in such mathematicsrelated fields as systems analysis, operations research, or actuarial science. The Master of Mathematical Finance (MMF) program at Illinois Tech is a professional (nonthesis) interdisciplinary program offered jointly by the Department of Applied Mathematics in the College of Science and the Stuart School of Business. The purpose of the class is to expose undergraduate and graduate students to the mathematical concepts and techniques used in the financial industry. Mathematics lectures are mixed with lectures illustrating the corresponding application in the financial industry. MIT mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance. This course on Mathematics of Finance presents the basic tools for financial calculations. It aims at satisfying the needs for the application of mathematics of finance concepts through a standard computer software Excel widely used by students and professionals all over the world for finance and capital markets. Excel, which is a very helpful and powerful tool, provides the user with a. The BSc in Mathematics with Finance has been developed in partnership with industry, and combines the development of mathematical and statistical skills with finance modules in the Queens Management School to further insight into capital markets. Tim Johnson is an RCUK Academic Fellow in Financial Mathematics, based at HeriotWatt University and the Maxwell Institute for Mathematical Sciences in Edinburgh. He is active in promoting the sensible use of mathematics in finance and highlighting the need for more research into mathematics in order to better understand random and complex environments. Mathematics is the study and application of arithmetic, algebra, geometry, and analysis. Mathematical methods and tools, such as MATLAB and Mathematica, are used to model, analyze, and solve diverse problems in a range of fields, including biology, computer science, engineering, finance, medicine, physics, and the social sciences. Mathematics is essential in many fields, including natural science, engineering, medicine, finance and the social sciences. Applied mathematics has led to entirely new mathematical disciplines, such as statistics and game theory. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic analysis. This has led to important developments e. Our Mathematics with Management Finance BSc offers you the opportunity to study mathematics at an advanced level at the same time as developing an understanding of the principles and developing trends in management and finance. Mathematics with Finance utilises the expertise from both the College of Engineering, Mathematics and Physical Sciences and The Business School. This programme provides invaluable mathematics skills alongside a theoretical background in finance. We use cookies to improve your website experience. To learn about our use of cookies and how you can manage your cookie settings, please see our Cookie Policy. By closing this message, you are consenting to our use of cookies. Mathematics of finance multiple choice questions (MCQ), mathematics of finance quiz answers pdf 1 to learn online mathematics course. Mathematics of finance MCQs on single payment computations, annuities and present value, annuities and future values for. The Department of Mathematics at Columbia University offers a Master of Arts program in Mathematics with specialization in the Mathematics of Finance (MAFN). It is cosponsored by the Department of Statistics, and it draws on the diverse strengths of the university in mathematics, statistics, stochastic processes, numerical methods, and. The Mathematical Finance Section of the Department of Mathematics at Imperial College London, is devoted to research on mathematical modeling and computational methods in finance. It is the largest research group in Mathematical Finance in the UK and is recognized as one of the world's leading research groups in this field. Business and mathematics go hand in hand. If you love maths and want to learn how to use your skills in the business world, this BSc (Hons) Mathematics for Finance and Management degree course can give you the skills, knowledge and practical experience you need..